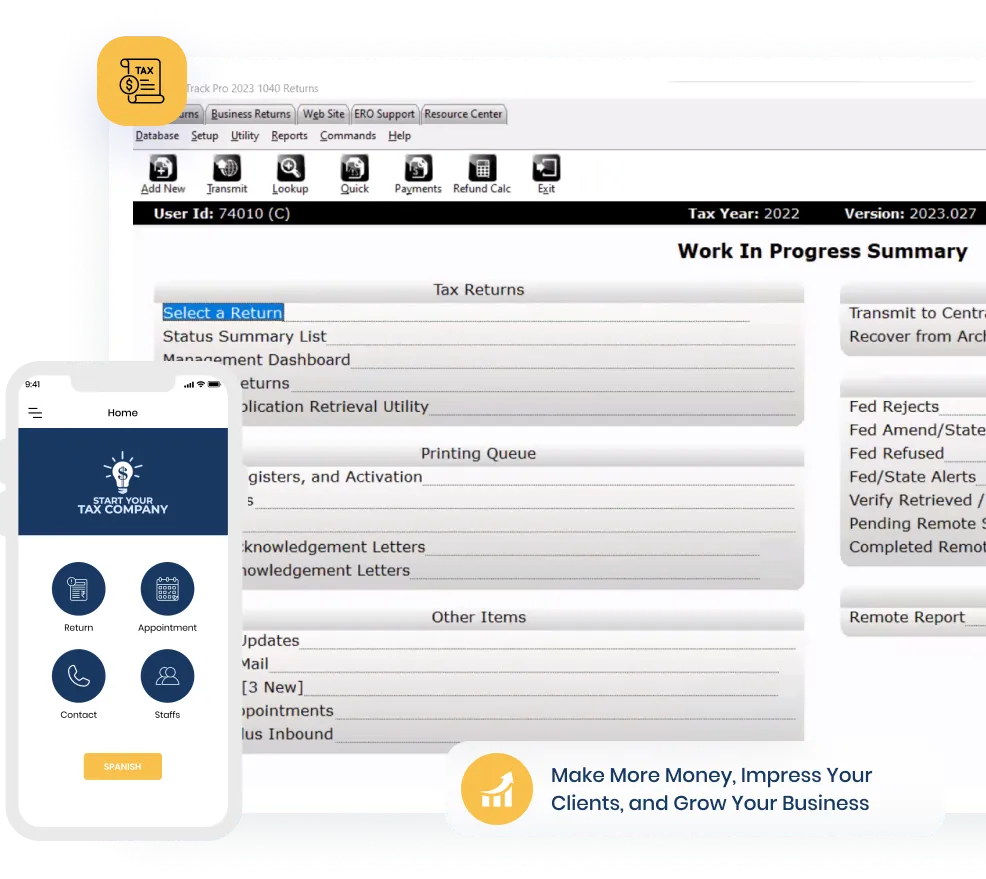

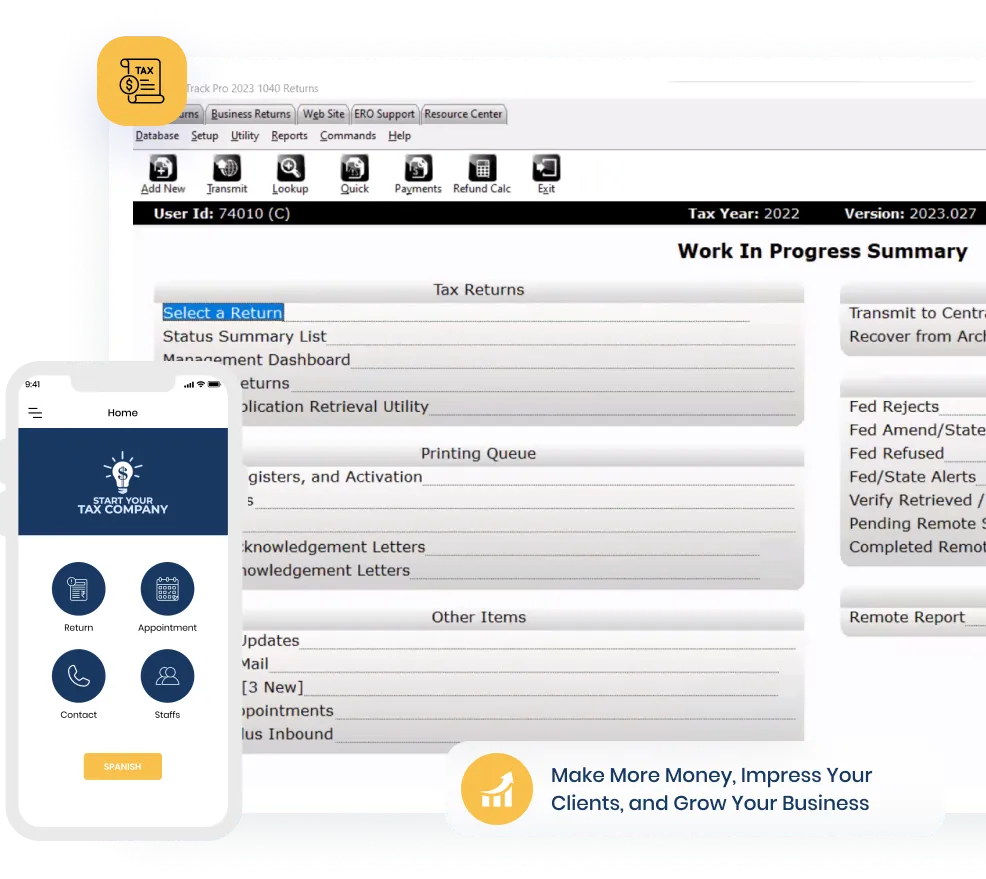

Free Professional Tax Software at the tips of your fingers

Free Professional Tax Software at the tips of your fingers

Our Services

Our platform offers a comprehensive set of tools and resources to help you get started. Here are some of the key features:

Our Services

Our platform offers a comprehensive set of tools and resources to help you get started. Here are some of the key features:

Why Choose Us?

Imagine if we told you that you can start your business with us even if you don't have an Electronic Filing Identification Number (EFIN)? Many tax preparation software providers require you to have an EFIN before you can use their software, which can be a major obstacle for new tax preparers.

But even if you already have an EFIN, Tax on Track can still provide value to your business. Our platform offers professional tax software, training and support, marketing and branding tools, compliance and security features, and affordable pricing. We are committed to helping you grow your business and succeed in the tax preparation industry.

Choose the right plan for

your business

Hundreds of individuals just like you have built their dreams with us

Why Choose Us?

Imagine if we told you that you can start your business with us even if you don't have an Electronic Filing Identification Number (EFIN)? Many tax preparation software providers require you to have an EFIN before you can use their software, which can be a major obstacle for new tax preparers.

But even if you already have an EFIN, Tax on Track can still provide value to your business. Our platform offers professional tax software, training and support, marketing and branding tools, compliance and security features, and affordable pricing. We are committed to helping you grow your business and succeed in the tax preparation industry.

Choose the right plan for

your business

Hundreds of individuals just like you have built their dreams with us

Starter

This package is designed for individuals who are new to the tax preparation industry and want a comprehensive solution to get started.

$549

50/50 Split

Professional Tax Software

Training(s) (Using the software & Learning how to market your tax company)

Bank Product

Review of each return complete

Group Training ( Software, Marketing, Business Growth)

Marketing E-Flyers ( 2 weeks worth)

Pro

This package is ideal for individuals who are looking to grow their business and attract more clients.

$749

60/40 Split

Professional Tax Software

Training(s) (Using the software & Learning how to market your tax company)

Bank Product

Review of each return complete

Group Training ( Software, Marketing, Business Growth)

Mobile App

Marketing E-Flyers ( 1 Month worth)

Premium

This package is designed for individuals who have some experience in the tax preparation industry and are looking to expand their business.

$997

80/20 Split

Professional Tax Software

Training(s) (Using the software & Learning how to market your tax company)

Bank Product

Review of each return complete

1 on 1 45 min.Zoom Conference w/ Founder (Ms.Keisha)

Mobile App

Marketing Uniform

Marketing Flyers (Designed, Printed and Shipped to you)

Starter

This package is designed for individuals who are new to the tax preparation industry and want a comprehensive solution to get started.

$497

50/50 Split

Professional Tax Software

Training(s) (Using the software & Learning how to market your tax company)

Bank Product

Review of each return complete

Group Training ( Software, Marketing, Business Growth)

Marketing E-Flyers ( 2 weeks worth)

Pro

This package is ideal for individuals who are looking to grow their business and attract more clients.

$747

60/40 Split

Professional Tax Software

Training(s) (Using the software & Learning how to market your tax company)

Bank Product

Review of each return complete

Group Training ( Software, Marketing, Business Growth)

Mobile App

Marketing Uniform

Marketing E-Flyers ( 1 Month worth)

Premium

This package is designed for individuals who have some experience in the tax preparation industry and are looking to expand their business.

$997

80/20 Split

Professional Tax Software

Training(s) (Using the software & Learning how to market your tax company)

Bank Product

Review of each return complete

1 on 1 45 min.Zoom Conference w/ Founder Ms.Keisha

Mobile App

Marketing Uniform

What We Offer

Checklist

We will provide you with a checklist of everything you need to start your tax preparation business, including software, hardware, and other essential tools.

Onboarding

Our team will guide you through the process of getting started , including setting up your account, accessing our software, and understanding our platform.

Professional Tax Software

You will have access to our professional tax software, which is designed to be easy to use and efficient, helping you complete tax returns quickly and accurately.

Bank Product

You will have the option to provide your clients with bank product. This feature allows you to offer loans before and during tax season.

Intake Sheets

You will receive all the intake sheets you need to collect information from your clients, making it easy to complete their tax returns accurately and efficiently.

Training(s)

Our team of experts is always available to provide training and support, ensuring that you have the skills & knowledge need succeed in the tax preparation industry.

Marketing/ Branding

We offer a range of marketing and branding tools to help you promote your business and attract more clients, including custom logos, flyers, and other materials.

Tech Support

Our team will guide you through the process of getting started , including setting up your account, accessing our software, and understanding our platform.

What We Offer

Checklist

We will provide you with a checklist of everything you need to start your tax preparation business, including software, hardware, and other essential tools.

Onboarding

Our team will guide you through the process of getting started , including setting up your account, accessing our software, and understanding our platform.

Professional Tax Software

You will have access to our professional tax software, which is designed to be easy to use and efficient, helping you complete tax returns quickly and accurately.

Bank Product

You will have the option to provide your clients with bank product. This feature allows you to offer loans before and during tax season.

Intake Sheets

You will receive all the intake sheets you need to collect information from your clients, making it easy to complete their tax returns accurately and efficiently.

Training(s)

Our team of experts is always available to provide training and support, ensuring that you have the skills & knowledge need succeed in the tax preparation industry.

Marketing/ Branding

We offer a range of marketing and branding tools to help you promote your business and attract more clients, including custom logos, flyers, and other materials.

Tech Support

Our team will guide you through the process of getting started , including setting up your account, accessing our software, and understanding our platform.

Frequency Asked Questions

Millions of customers have built their dreams with us

When does tax season start?

At the moment the IRS hasn't released the exact start date for 2024. Tax season usually starts in Mid January. Pre Ac loans usually start Jan.3

What’s needed to become a partner with Start Your Tax Company?

Be a citizen ( Have an ID and SSN). You will also need an approved PTIN letter from IRS

Can I use my company branding?

Yes. We encourage you to use your own branding while marketing. You also have the option to use your own logo with our mobile app feature.

Is there a fee associated?

Yes, there is only a ONE time fee pre season.

Why is there a fee?

The one time fee is to cover the cost of support and training. You will have questions throughout tax season and our team of experts will be able to support you. You will also have trainings

What if I get stuck during a tax return?

You will have the option to call, email or text us for support.

How long is training during tax season?

We will provide you with a list of topics, dates and times for each scheduled training before tax season starts.

Can I opt out?

Yes, you can. There aren't any refunds.

Frequency Asked Questions

Millions of customers have built their dreams with us

When does tax season start?

At the moment the IRS hasn't released the exact start date for 2024. Tax season usually starts in Mid January. Pre Ac loans usually start Jan.3

What’s needed to become a partner with Start Your Tax Company?

Be a citizen ( Have an ID and SSN). You will also need an approved PTIN letter from IRS

Can I use my company branding?

Yes. We encourage you to use your own branding while marketing. You also have the option to use your own logo with our mobile app feature.

Is there a fee associated?

Yes, there is only a ONE time fee pre season.

Why is there a fee?

The one time fee is to cover the cost of support and training. You will have questions throughout tax season and our team of experts will be able to support you. You will also have trainings

What if I get stuck during a tax return?

You will have the option to call, email or text us for support.

How long is training during tax season?

We will provide you with a list of topics, dates and times for each scheduled training before tax season starts.

Can I opt out?

Yes, you can. There aren't any refunds.